Table of Contents

How to Build Credit With a Credit Card

Do you cringe every time you pull up your credit report? Do you wince at the end of the month when your bills are due? Are you looking to get a mortgage or car loan in the foreseeable future? If you answered yes to any of these questions, keep reading.

Boosting your credit score takes some work. It doesn’t happen overnight, but that shouldn’t dissuade you from putting the effort in. Your credit score is essentially your adulthood report card. Banks will reward you for a top-notch score and punish you for low scores. But unlike elementary school, where you could easily figure out how to do better, navigating credit is a bit trickier.

Before you go any further, take a look at your score in your latest credit report. Anything from 580 to 669 is considered fair; 670 to 739 is considered good; and 740 to 799 is considered very good. If you’re above 800, then you are an A+ student and probably don’t need to be reading this article!

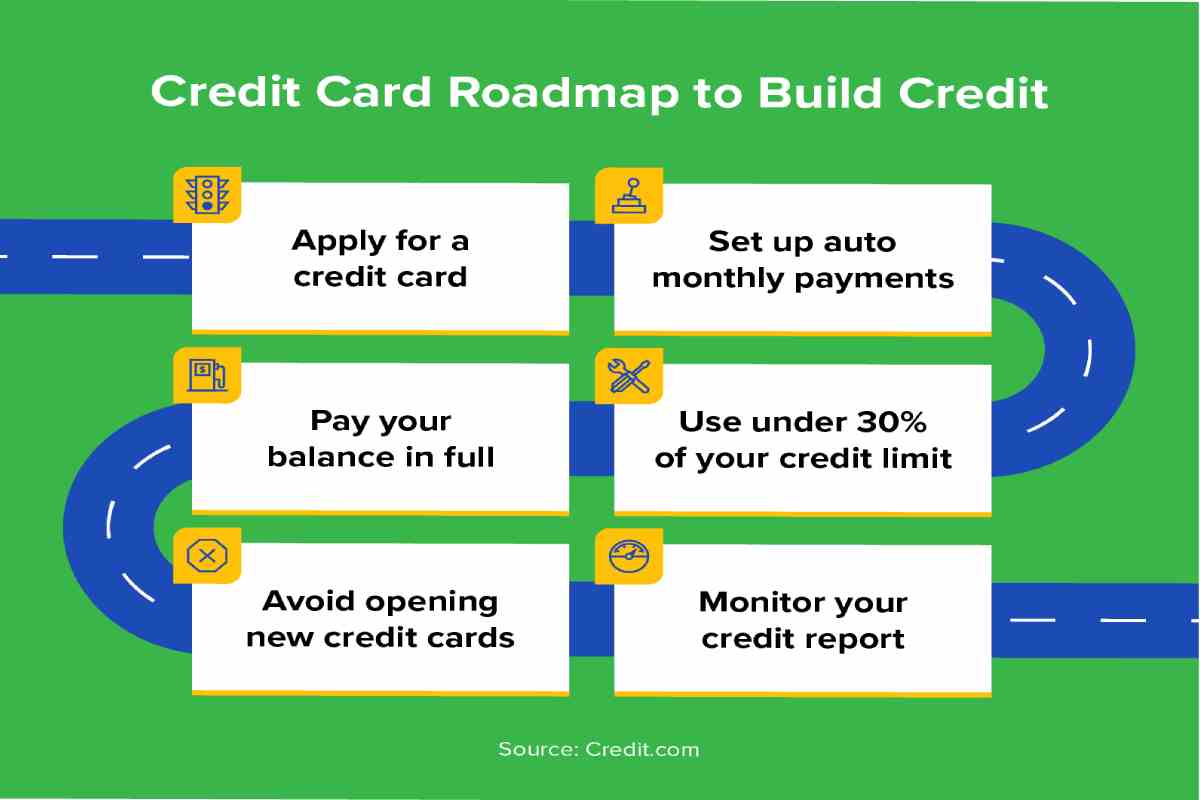

Now that you know your starting place, think about your goals and where you want to be. Then keep reading for tips on building your credit score with a credit card, including how to get one in the first place.

1. Getting a Credit Card

Getting a credit card with poor credit may seem like a bit of a Catch-22; however, you do have some options. First, if you have a certain amount of cash to set aside, consider getting a secured credit card. The amount you put down to secure the card becomes your credit limit. At the same time, it reduces the issuer’s risk, which means secured cards are easier to qualify for. You also won’t go into debt, as you can only charge as much as you’ve given to the bank beforehand.

Second, if you are in college, you can look into getting a student credit card. These cards tend to have lower credit limits based on the average age of individuals applying for them. Issuers consider college students good long-term financial bets, so you may more easily qualify for this type of card as well.

Third, you can ask a family member or really close friend to add you as an authorized user on their credit card. If you go this route, you need to be really serious about when you use this card. Your family member or friend is putting their own credit on the line by adding you to their account, so use it wisely!

2. Pay Your Bill on Time

Now that you have a credit card, the real work comes into play. You need to remember to pay at least the minimum balance on time each month.

Your payment history is one of the most important factors that goes into your credit score. If you miss a bill, the bank may penalize you depending on your agreement. This could involve an extra fee or even an increase in your interest rate.

Remembering to pay your bill takes some practice. Set up reminder emails from your bank for when statements are due. Also, set a reminder on your phone a day or two before the bill’s due date. If you’re a visual person, you can also write it on your planner or wall calendar. Of course, digital reminders may be more helpful if you travel a lot and are away from home.

3. Or Pay It Early

A lesser-known trick to improving your credit score is to pay your bill early. Doing so will lower your credit utilization ratio. This ratio is the percentage of credit you’re using out of the total amount you have available.

Credit bureaus don’t like it when you use up all — or even a large amount — of your available credit. It signals to them that you may be spending more than you can afford. You can’t always control this, of course. If you are moving, for example, you may need to make expensive purchases such as furniture and appliances.

Paying your bill before the statement is prepared is one way to keep those large purchases off the credit bureaus’ radar. By removing those larger sums from the bureau’s calculations, you’ll lower your credit utilization ratio. There are further advantages to always paying your bill early. It can reduce interest charges and create room for other purchases you may need to make before month’s end.

4. Get Only What You Need

This last tip is for the “grass is always greener on the other side” readers out there. Once your credit is in a good place, you may be tempted to get a better, shinier credit card. While this can be helpful in some instances, it isn’t always necessary. In fact, if you try to get multiple cards at once, it will hurt your credit score. And canceling cards will reduce your credit history length, which will likewise harm your score.

So the better approach is often to stand pat with the credit cards you have. Many issuers will convert a secured card to a higher-limit traditional one after you demonstrate responsible card use over a certain period. This allows you to improve your credit utilization ratio and maintain your length of credit history in one fell swoop.

Only getting what you need also applies to what you’re actually spending on. As you are paying your bills, you will likely notice some patterns in your spending habits. The holidays and summer vacation are two times of the year when spending seems to skyrocket. Before these times, budget for what you are going to be buying and determine how to limit your overall spending. Remember, the best credit score doesn’t go to someone who ends up spending the most money.

Takeaways

A good or excellent credit score will help you in life. Building your score takes a bit of work, but it is well worth the effort. You can start building your score with a credit card you currently have or plan to get in the near future.

If you need further assistance, speak with a trustworthy financial advisor. They can help get you on the right track and provide additional guidance for your unique monetary situation.